mississippi income tax payment

Still the state does impose Social Security and Unemployment Insurance SUI on employees. Mississippis Republican-controlled legislature passed legislation in 2022 that will eliminate the states 4 income tax bracket starting in 2023.

Mississippi Governor Signs State S Largest Income Tax Cut

Combined Filers - Filing and Payment Procedures.

. Mississippis Republican-controlled legislature passed legislation in 2022 that will eliminate the states 4 income tax bracket starting in 2023. All other income tax returns. If theyre right the Mississippi state government will continue to be.

If filing a combined return. You will be taxed 3 on any earnings between 3000. Tax Tax Free Income.

The taxable wage base in Mississippi is 14000. Details on how to. Hurricane Katrina Information.

Because the income threshold for the top. Mississippi State Income Tax Forms for Tax Year 2022 Jan. Mississippi Income Taxes.

The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. Payment can be delayed until April 15th. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

0 on the first 4000 of taxable income. Yes if your spouse has Mississippi wages your spouse is required to file a nonresident tax return. File now pay later option.

You may also electronically file your Mississippi tax return through a tax preparer or using online tax software and pay your taxes instantly using direct debit or a credit card an additional. Your average tax rate is 1198 and your marginal. You can use this service to quickly and securely pay your Mississippi taxes using a.

You can pay online through TAP Direct deposit of individual income tax refunds is only available for e-file returns. 0621 Mississippi Individual Fiduciary Income Tax Voucher Instructions Who Must Make Estimated Tax Payments Every individual taxpayer who does not. Is my spouse required to file a Mississippi return and pay Mississippi taxes on that income.

Ordinary. 2022 tax rates for federal state and local. If you are receiving a refund.

Tax Tax Free Income. In the following three years the. Eligible Charitable Organizations Information.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. 4 on the next 5000 of taxable income. Welcome to The Mississippi Department of Revenue.

Mailing Address Information. 3 on the next 1000 of taxable income. 5 on all taxable income over 10000.

Mississippi Income Tax Calculator Calculate your federal Mississippi income taxes Updated for 2022 tax year on Aug 31 2022. SUI rates in Mississippi range from 0 to 54. No state has ever fully phased out a personal income tax so theres true way to know if this bet will pay off.

31 2022 can be e-Filed in conjunction with a IRS Income Tax Return. Mississippi Income Tax Calculator 2021. In the following three years the.

Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

Mississippi Governor Signs State S Largest Income Tax Cut Mississippi S Best Community Newspaper Mississippi S Best Community Newspaper

Mississippi Llc Tax Structure Classification Of Llc Taxes To Be Paid

Mississippi Lawmakers Pass Largest Ever State Income Tax Cut The Oxford Eagle The Oxford Eagle

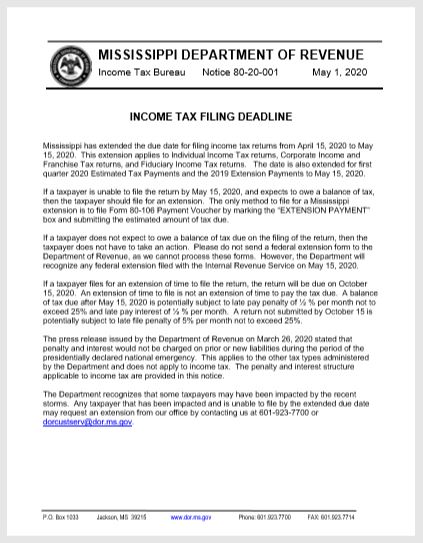

Mississippi Dor Reminds Taxpayers That Income Tax Returns Are Due May 15 Cooking With Salt

Mississippi Who Pays 6th Edition Itep

Mississippi State Tax Software Preparation And E File On Freetaxusa

Mississippi Tax Commission To Make Change For Correct Sales Tax Payment 2 Coins Ebay

How To File And Pay Sales Tax In Mississippi Taxvalet

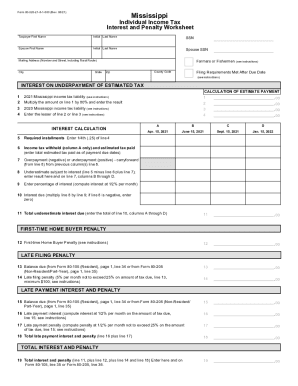

Form 80 106 Individual Fiduciary Income Tax Voucher

Get And Sign Ms State Tax Forms 2021login Pages Finder Login Faq Com 2021 2022

Can Mississippi Afford To Raise Teacher Pay And Eliminate The Income Tax Mississippi Today

Historical Mississippi Tax Policy Information Ballotpedia

Mississippi Governor Signs State S Largest Income Tax Cut The San Diego Union Tribune

Income Tax Phaseout Up For Debate In Long Poor Mississippi Mynorthwest Com

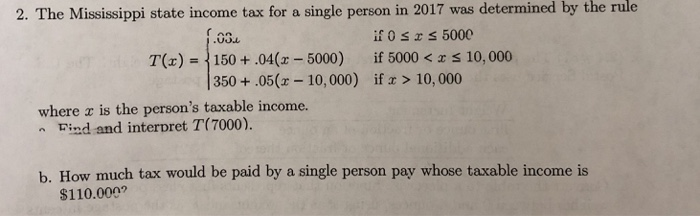

Solved 2 The Mississippi State Income Tax For A Single Chegg Com

Payroll Software Solution For Mississippi Small Business

States With The Highest Lowest Tax Rates

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy